Archive Post

Home / Notices

Category: Notices

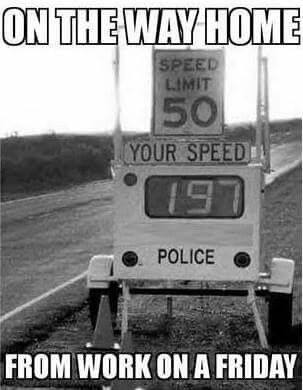

⭐ALERT! Supreme & Lower Courts Rule “No License Necessary to Drive on Public Highways”

https://www.youtube.com/embed/WTytQVZ-gTM I'm NOT a lawyer and nothing in this video is to be taken as…

Beat Any Victimless Case in America

I am constantly getting the question: “I got arrested and now I have court in…

The Poison Needle

Some very interesting suppressed information is within this post. God never meant for us to…

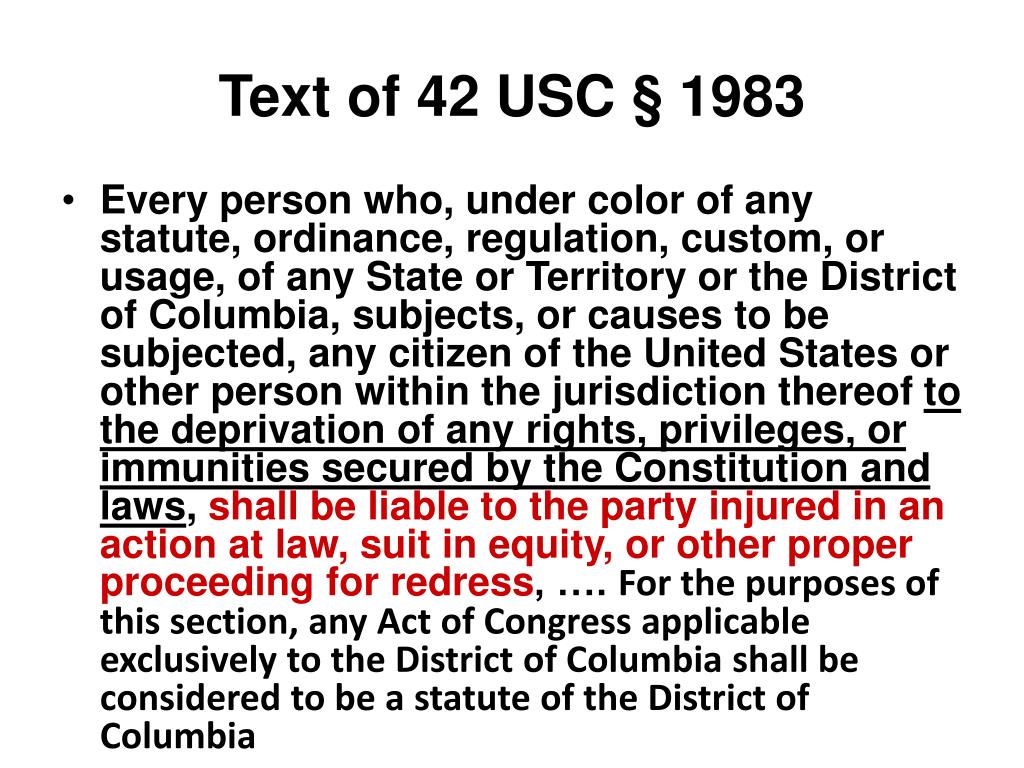

Color of Law

"Color" means "An appearance, semblance, or simulacrum, as distinguished from that which is real. A…

No Victim, No Crime!

CORPUS DELICTI "For a crime to exist, there must be an injured party (Corpus Delicti)…

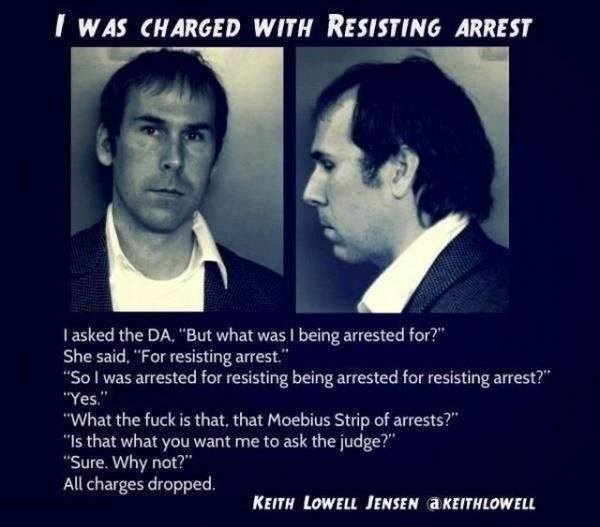

Resisting Arrest?

There is no such crime as “resisting arrest" when the supposed arrest is unlawful. This…

UNITED STATES rules and regulations only apply to “PERSONS”!

“The Official State Office Known As "PERSON" This is the single most important lesson that…

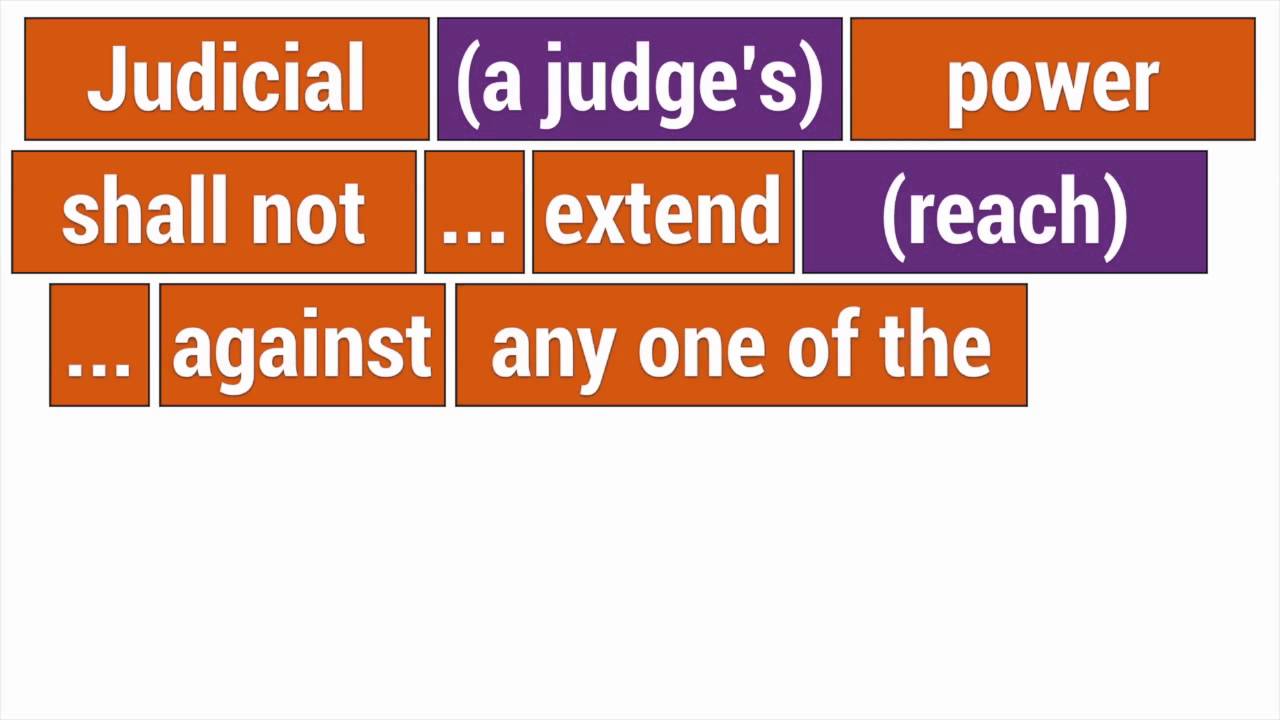

“We The People” have 11th Amendment Immunity!

Most people are unaware that "We the people" have 11th Amendment immunity! 11th Amendment Immunity1.)…

American Citizen, or U.S. citizen?

There appears to be general misunderstanding by people in general as to the difference between…