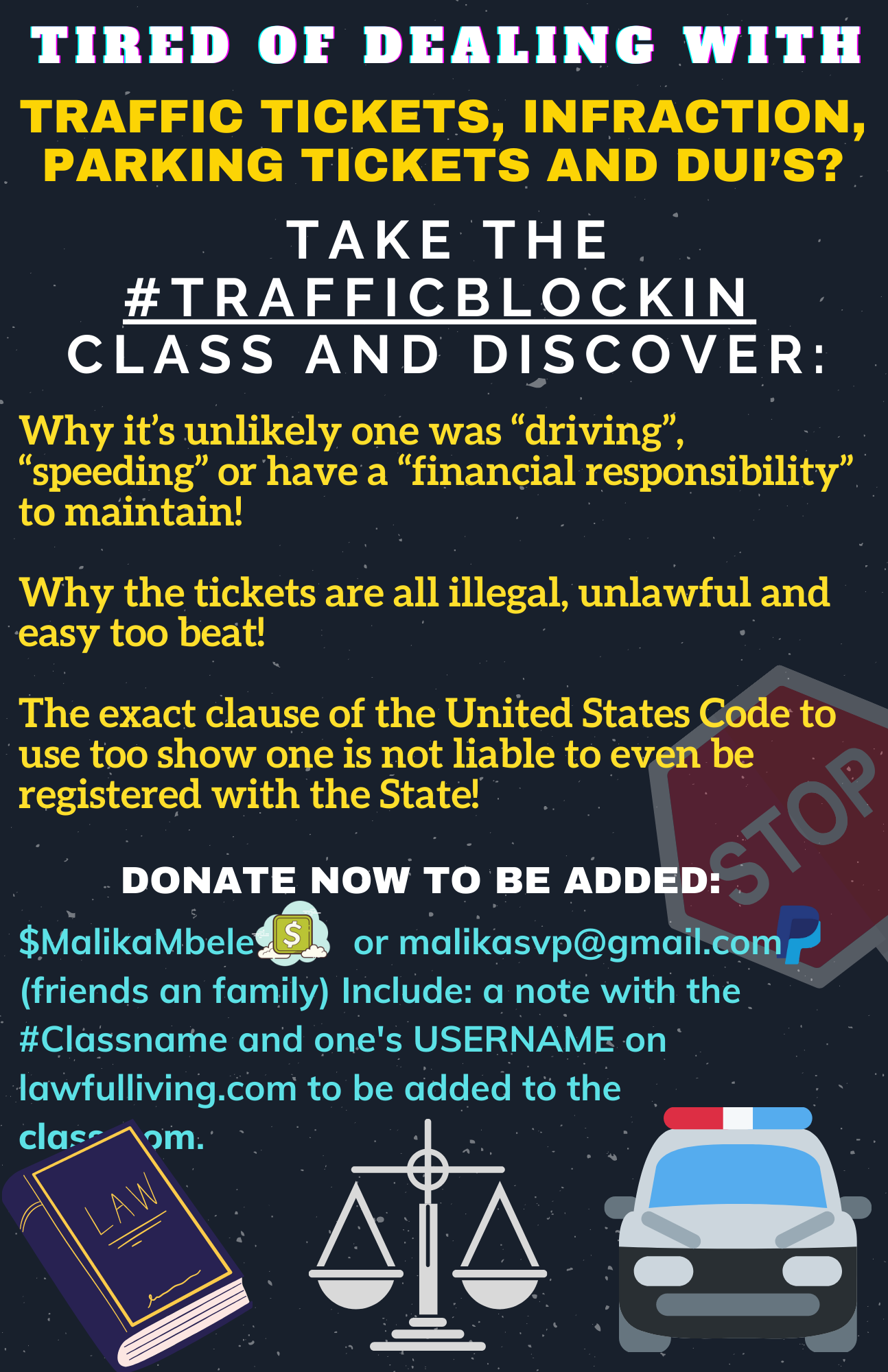

To sign up for the traffic ticket terminator class, click here, NOW!

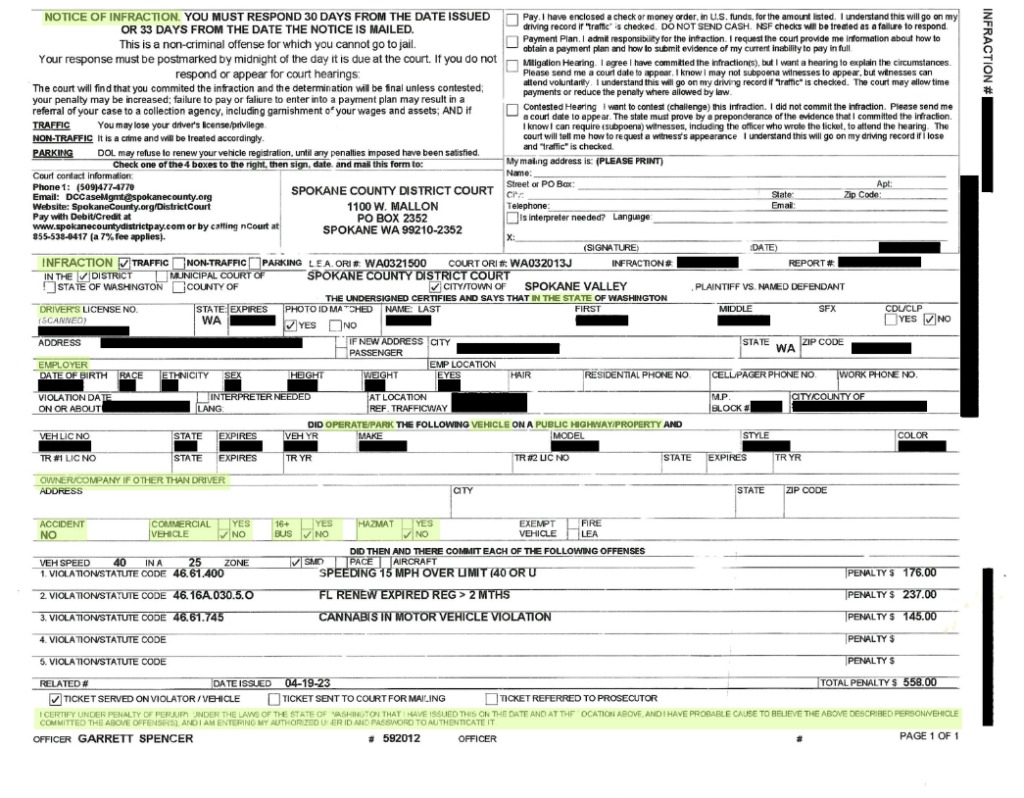

There are a few terms that we need to comprehend in order to defeat and terminate any traffic ticket or parking citation. Those main terms are often found on the traffic ticket or citation itself so this will be easier if one has the ticket in hand.

Traffic tickets are based on the erroneous presumption that any time someone is behind the wheel of a car or truck that they are in fact a “driver” that “operates” or is currently “operating” a “motor vehicle” in interstate, intrastate or foreign “commerce”. The ticketing officer usually has no idea of what evidence is required to support their presumption and neither do their unsuspecting traffic ticket and parking citation victims! Below we research and evaluate those terms so we can best rebut them to beat the tickets!

PRESUMPTION: Driver means any person who operates any commercial motorvehicle … on a “public highway” “in the state”.

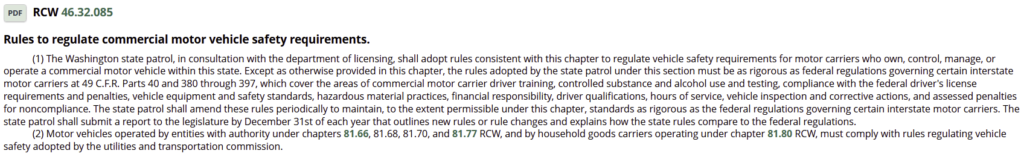

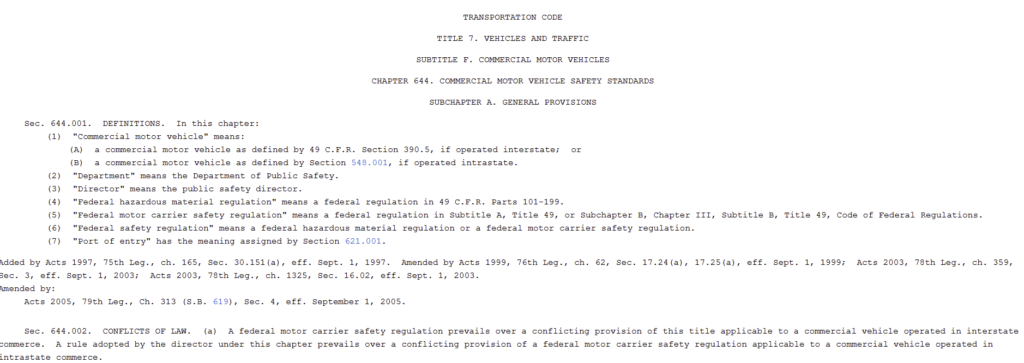

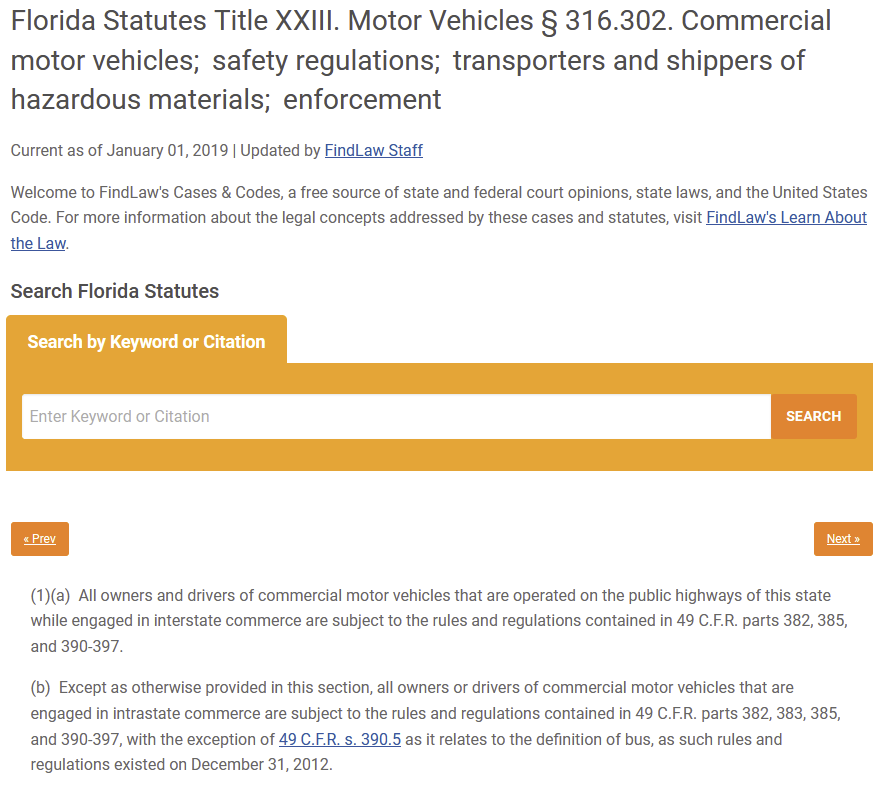

The presumption above is found in whole or part of every states transportation, motor vehicle or drivers services code or statute. It is easily defeated by breaking up the sentence then breaking down the terms. Every state code or statute will reference the Federal Motor Vehicle Safety Act codified at 49 Code of Federal Regulation (CFR) (see image below). The definitions of what is being enforced are found in section 390.5 which means the same definitions apply in every state regardless of if the state itself may have a slightly different definition in their state code.

Washington State

Texas State

Florida State

Person

Person means an individual, firm, corporation, partnership, association, State, municipality, commission, or political subdivision of a State, or any interstate body, as well as a department, agency, or instrumentality of the executive, legislative, or judicial branch of the Federal Government. This definition includes railroads.

Operate

(2) No motor carrier or intermodal equipment provider shall require or permit any person to operate nor shall any person operate any motor vehicle or intermodal equipment declared and marked out-of-service until all repairs required by the out-of-service notice have been satisfactorily completed. The term operate as used in this section shall include towing the vehicle or intermodal equipment, except that vehicles or intermodal equipment marked out-of-service may be towed away by means of a vehicle using a crane or hoist. A vehicle combination consisting of an emergency towing vehicle and an out-of-service vehicle shall not be operated unless such combination meets the performance requirements of this subchapter except for those conditions noted on the Driver Vehicle Examination Report.

Commercial motor vehicle

Commercial motor vehicle means any self-propelled or towed motor vehicle used on a highway in interstatecommerce to transport passengers or property when the vehicle –

(1) Has a gross vehicle weight rating or gross combination weight rating, or gross vehicle weight or gross combination weight, of 4,536 kg (10,001 pounds) or more, whichever is greater; or

(2) Is designed or used to transport more than 8 passengers (including the driver) for compensation; or

(3) Is designed or used to transport more than 15 passengers, including the driver, and is not used to transport passengers for compensation; or

(4) Is used in transporting material found by the Secretary of Transportation to be hazardous under 49 U.S.C. 5103 and transported in a quantity requiring placarding under regulations prescribed by the Secretary under 49 CFR, subtitle B, chapter I, subchapter C.

https://www.law.cornell.edu/cfr/text/49/390.5

For-hire motor carrier means a person engaged in the transportation of goods or passengers for compensation.

Highway means any road, street, or way, whether on public or private property, open to public travel.

Interstate commerce means trade, traffic, or transportation in the United States—

(1) Between a place in a State and a place outside of such State (including a place outside of the United States);

(2) Between two places in a State through another State or a place outside of the United States; or

(3) Between two places in a State as part of trade, traffic, or transportation originating or terminating outside the State or the United States.

Intrastate commerce means any trade, traffic, or transportation in any State which is not described in the term “interstate commerce.â€

Title 49 Transportation Subtitle B – Other Regulations Relating to Transportation CHAPTER III – FEDERAL MOTOR CARRIER SAFETY ADMINISTRATION, DEPARTMENT OF TRANSPORTATION SUBCHAPTER B – FEDERAL MOTOR CARRIER SAFETY REGULATIONS Subpart A Definitions 49CFR390_5

CAN IT BE ANY MORE CLEAR TO WHOM AND WHEN THESE RULES AND REGULATIONS APPLY?

Now let’s briefly go over WHERE the traffic regulation is applicable. It says on the ticket, “IN THE STATE” but, does the ticketing agent know what that means?

Territorial Jurisdiction of Traffic Ticket

Before we get to the specific definitions of the territorial jurisdiction of the states as defined in the state codes and statutes let’s see how the federal codes define the same under title 4 USC (subject natter of this title is STATES).

4 U.S. Code § 110 – Same; definitions

(a) The term “person†shall have the meaning assigned to it in section 3797 of title 26.

(b) The term “sales or use tax†means any tax levied on, with respect to, or measured by, sales, receipts from sales, purchases, storage, or use of tangible personal property, except a tax with respect to which the provisions of section 104 of this title are applicable.

(c)The term “income tax†means any tax levied on, with respect to, or measured by, net income, gross income, or gross receipts.

(d) The term “State†includes any Territory or possession of the United States.

(e) The term “Federal area†means any lands or premises held or acquired by or for the use of the United States or any department, establishment, or agency, of the United States; and any Federal area, or any part thereof, which is located within the exterior boundaries of any State, shall be deemed to be a Federal area located within such State.

Alabama Title 1 – General Provisions.

Chapter 1 – Construction of Code and Statutes.

Section 1-1-1

STATE. The word “state,” when applied to the different parts of the United States, includes the District of Columbia and the several territories of the United States

Alaska Title 43. Revenue and Taxation

Sec. 43.19.010.

State means a state of the United States, the District of Columbia, the Commonwealth of Puerto Rico, or any territory or possession of the United States.

Section 1. ARS 28-101. Definitions 74. “State” means a state of the United States and the District of Columbia.

Section 28-5601, Arizona Revised Statutes: ” In this state” means any way or place within the exterior limits of the state of Arizona that is maintained by public monies, including any such way or place that is owned by or ceded to the United States of America.

Arkansas Code Title 26 – Taxation

Subtitle 5 – State Taxes Chapter 53 – Compensating or Use Taxes

Subchapter 1 – Arkansas Compensating Tax Act of 1949

§ 26-53-102. Definitions.

(12) “In this state” or “in the state” or “within this state” means within the exterior limits of the State of Arkansas and includes all territory within those limits owned by or ceded to the United States of America;

California Revenue and Taxation Code – RTC

DIVISION 1. PROPERTY TAXATION

PART 1. GENERAL PROVISIONS

CHAPTER 1. Construction

RTC 130 (f) “In this State” means within the exterior limit of the State of California, and includes all territory within these limits owned by, or ceded to, the United States of America.

Colorado Revised Statutes Title 39 – Taxation

Specific Taxes

Article 27 – Gasoline and Special Fuel Tax

Part 1 – Gasoline Tax

§ 39-27-101. Definitions – construction

Universal Citation: CO Rev Stat § 39-27-101

As used in this part 1, unless the context otherwise requires:

(15) In this State means within the exterior limits of the state of Colorado and includes all territories within these limits owned by or ceded to the United States of America.

Georgia Title 11 – Commercial Code

Article 1 – General Provisions

Part 2 – General Definitions and Principles of Interpretation

§ 11-1-201 (38) “State” means a state of the United States, the District of Columbia, Puerto Rico, the United States Virgin Islands, or any territory or insular possession subject to the jurisdiction of the United States.

Hawaii Code

DIVISION 3. PROPERTY; FAMILY

TITLE 30A. UNIFORM PROBATE CODE

560. Uniform Probate Code

2. DEFINITIONS “State” means a state of the United States, the District of Columbia, the Commonwealth of Puerto Rico, or any territory or insular possession subject to the jurisdiction of the United States.

REVENUE AND TAXATION Chapter 36 – SALES TAX

Section 63-3604 – IN THIS STATE — IN THE STATE.

Universal Citation: ID Code § 63-3604 (2018)

63-3604. IN THIS STATE — IN THE STATE. The terms “in this state” or “in the state” mean within the exterior limits of the state of Idaho and include all territory within these limits owned by or ceded to the United States of America.

BUSINESS AND OCCUPATION TAX Washington

Sections RCW 82.04.200 “In this state,” “within this state.”

“In this state” or “within this state” includes all federal areas lying within the exterior boundaries of the state.

Virginia § 19.2-272. Definitions. The word “state” shall include any territory of the United States and the District of Columbia.

https://law.lis.virginia.gov/vacode/title19.2/chapter16/section19.2-272/

West Virginia

Chapter 11. Taxation

Article 24. Corporation Net Income Tax

§11-24-3a. state The term “state” means any state of the United States, the District of Columbia, the Commonwealth of Puerto Rico, any territory or possession of the United States and any foreign country or political subdivision thereof. [We have found ALL 50 states definitions and put this in out “in the state” thread here in our private app community]

Obviously, even though it’s “territorial” jurisdiction being defined, it goes beyond geographical and physical location but what is being done there, as in activity. Consider the pattern revealed by the statutory definitions of what it means to be “in” these various “states”?

What type of activity must one be engaged in to be presumed to be “IN THE STATE”?

So, based on these definitions, in ones own words, why is the ticket or citation one received totally bogus?

Can one now formulate a sentence on rebutting that one was a “Driver which means any person who operates any commercial motorvehicle … on a “public highway” “in the state”?

To sign up for the traffic ticket terminator class, click here, NOW!

Cheryl Kissell

I actually have a judge in florida who has scheduled a “trial by jury” for February 2024 because they claim I DRIVING WHILE LICENSE SUSP OR REVOKED…I stopped using a license more than a decade ago when I learned I wasn’t a driver. So how can they make these charges against me?

Faith

Cheryl, I wish I had a way to contact you, but maybe you will see this. How did your case from 11/2023 work out?

Wilcox Derek

can you research connecticut

admin

go ahead and research it oneself and post what is found?\!

Adam Jachelski

Hi, I would like to be added to the Traffic Blockin class. How should I send a donation?

Thanks!

Stinky

Hello … I found a news report about a guy who was killed because he didn’t have a drivers license ! – https://jalopnik.com/yes-sovereign-citizens-you-do-need-a-drivers-license-1848423810

Yes, Sovereign Citizens, You Do Need a Driver’s License

And registration, and car insurance, and the ability to adhere to basic traffic laws

By Erin Marquis

Updated March 13, 2023.

Editor’s Note: This article was originally published on January 26, 2022. Today, March 13 2023, we’re revisiting this article after news that Chase Allan, a follower of the so-called Sovereign Citizen movement, was killed by police during a traffic stop stemming from a fake license plate Allan had on his car. Read on to learn more about the Sovereign Citizen movement in our original article below from 2022.

//

so my question is this, if we in truth don’t need a driver’s license, then how in the heck can we do so and drive without getting killed by a cop ?

i would appericate a reply from you to my personal email. [email protected] – thanku.

Elishis Betts

our you steal doing these classes if please let me know. .thsnks

TRoy

Yes, The class is still offered. Just click on “classes” and follow directions. If any issue email “support” and Sunny will help u.

TRoy

#Michigan https://www.legislature.mi.gov/Laws/MCL?objectName=mcl-445-571&QueryID=168895913 (k) “Within this state” means within the exterior limits of the state of Michigan, and includes the territory within these limits owned by or ceded to the United States of America.