Archive Post

Home / Strategy

Category: Strategy

Meeting The Deputy For The First Time

https://www.youtube.com/embed/kiF-RD1J714 this was the first time I met the local deputy

A judge is not the court.

"A judge is not the court." People v. Zajic, 88 Ill.App.3d 477, 410 N.E.2d 626…

Insurance is a scam.

There was a time when you didn’t have to buy car insurance. Risky? Reckless? Maybe.…

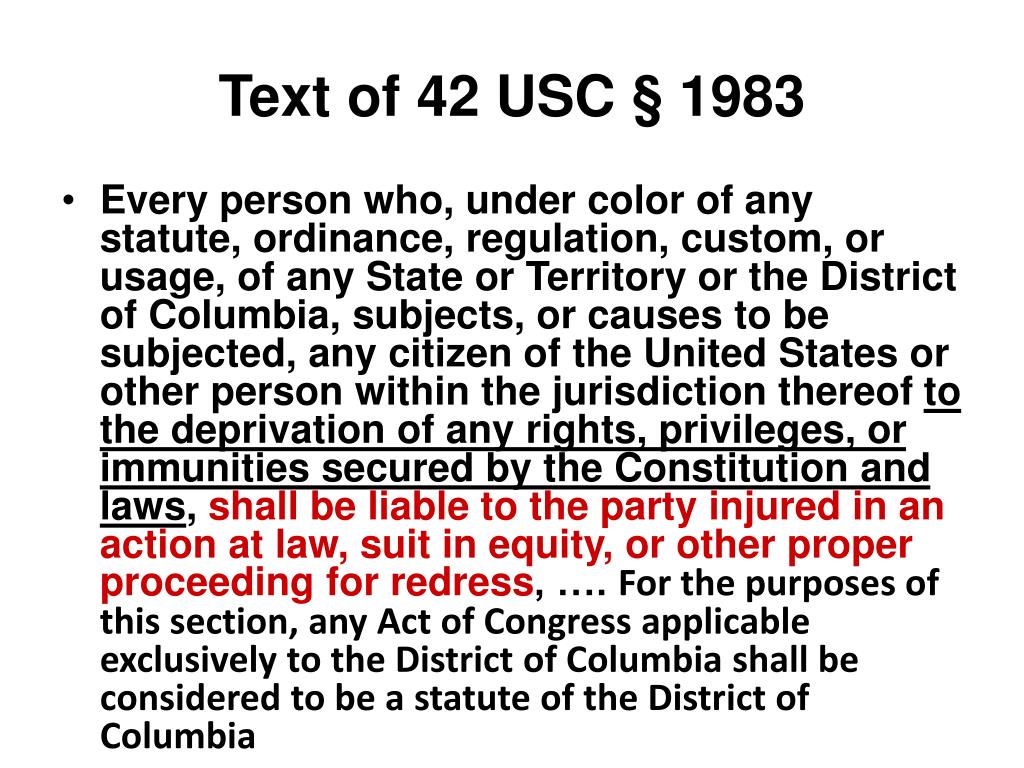

Section 1983 Outline

Coming to you from the United States Court of Appeals for the Ninth Circuit Office…

Beat Any Victimless Case in America

I am constantly getting the question: “I got arrested and now I have court in…

Color of Law

"Color" means "An appearance, semblance, or simulacrum, as distinguished from that which is real. A…