Owned and Operated By:

When they try to call you an “operator”… I am sure that we have all heard the phrase: “Owned and OPERATED by…” which clearly would be in reference to a…

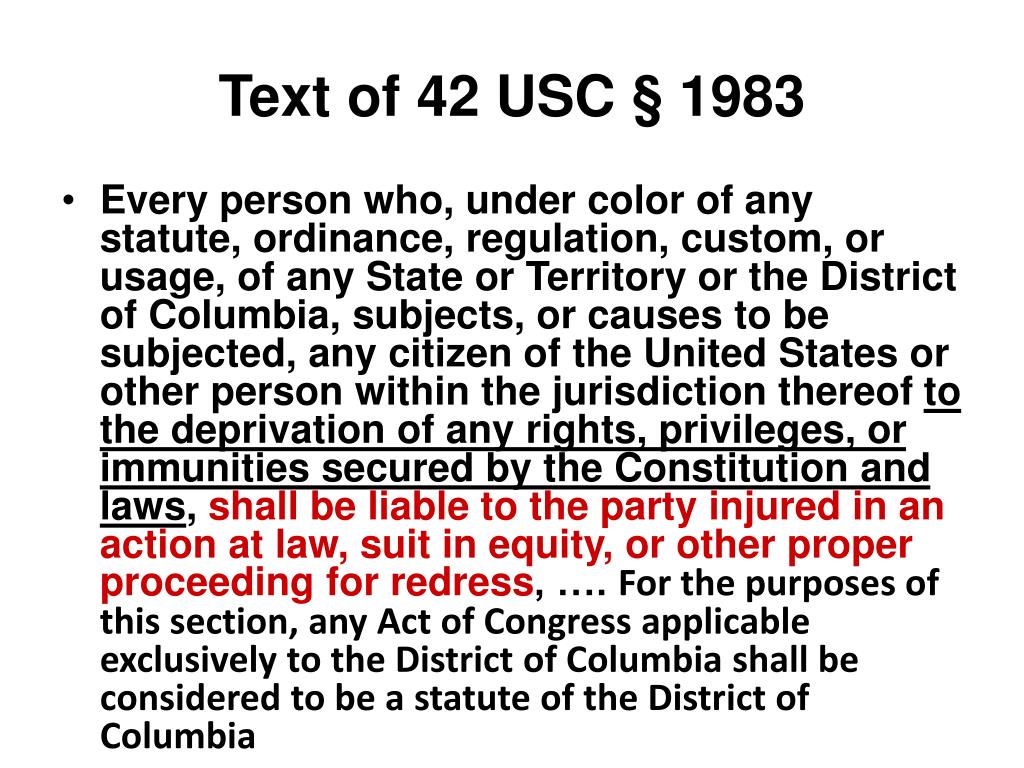

Section 1983 Outline

Coming to you from the United States Court of Appeals for the Ninth Circuit Office of Staff Attorneys; it is none other than the Section 1983 Outline. Very interesting reading…

How long do the axinated have to live?

Let’s remember the 20th anniversary of 9/11 by looking into one of today’s topics less published about, but being talked about quite a bit. (If you see this article, be…

Beat Any Victimless Case in America

I am constantly getting the question: “I got arrested and now I have court in a week… what do I do???†Right away I want to say that the following…

The Poison Needle

Some very interesting suppressed information is within this post. God never meant for us to put needles in our bodies. When vaccinations first were introduced the rate of diabetes skyrocketed…

152 Tax Facts

Only the rare taxpayer would be likely to know that he could refuse to produce his records to Internal Revenue Service agents. U.S. v. Dickerson, 413 F2d 1111 A person…

10 Points About Law

Law1. It is not presumed that the common law is changed by passage of a statute which gives no indication that it proposes such a change. Atkins v. United States,…

Color of Law

"Colorable" means "That which is in appearance only, and not in reality, what it purports to be, hence counterfeit feigned, having the appearance of truth." Windle v. Flinn, 196 Or.…

No Victim, No Crime!

CORPUS DELICTI “For a crime to exist, there must be an injured party (Corpus Delicti) There can be no sanction or penalty imposed on one because of this Constitutional right.”…